Is “Your Money or Your Life” by Vicki Robins still useful in 2023?

As a long-time lover of personal finance and money books, I had heard about Vicki Robins’s Your Money or Your Life (affiliate link) for years. It’s a seminal text in the personal finance field and has even been highly recommended by many, including people whose opinion I value highly like Ali Abdaal, who claimed it “changed my relationship with money.”

Did it live up to the hype? Let’s discuss.

Your Money or Your Life Book Summary

The main points of the book are:

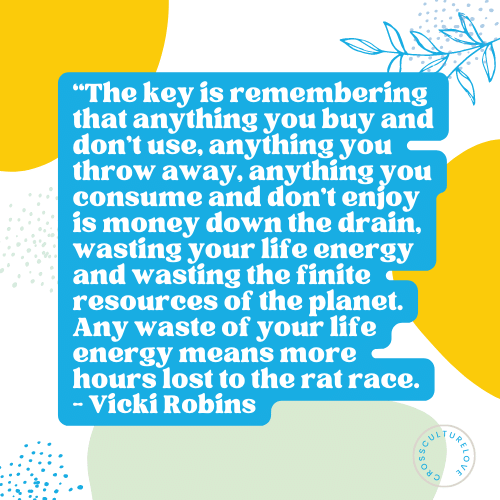

- Your money isn’t just an inanimate thing, it’s a reflection of your life energy (hours worked), and your real hourly wage is what you make when you factor in all the costs of being alive to do your job.

- In our modern world, your job isn’t something you do; it’s something you are.

- The focus on having enough is more important than the endless pursuit of more.

- Are we spending consciously, and is our life energy being used well when it comes to what we are buying?

These are excellent points. I think it’s very easy to detach our money from our energy, and I think it’s becoming increasingly easy as we move completely away from a cash economy to a credit economy. When you never physically, tangibly see the money, it’s easy to act like it’s all a video game. I think the concept of money has never been less real and tangible. The majority of jobs never actually hand over physical money, it’s all direct deposited. There’s no surprise that the average person has such a weird relationship with the idea of money as a physical thing or as a representation of real-life spent to earn it.

Your Money or Your Life was probably mindblowing (in 1992)

So, I read the 2018 version that was updated to reflect the more modern times, and you could certainly tell that Vicki made efforts to freshen up the book’s contents. There is talk about climate change, she addresses the fact that there are online tools to use, and other fun updates.

However, what wasn’t updated with the fact that this book is way too long. That isn’t to say that the information is invaluable, but this 370-page book could certainly have been 200 pages, maximum. I don’t like to be nitpicky about the length of books, but as even someone who is passionate about this topic, Your Money or Your Life was too long even for me. We have the internet now. Nobody has that sweet, sweet, 1992 attention anymore.

Maybe this is just a me problem and the other people don’t mind the length and depth and hearing the same point reiterated dozens of times. I’m aware that my poor attention span may not be universal. However, throughout the course of the book, I kept having the “this could have been a paragraph, not a chapter” feeling. For a book about how time = money, it certainly took a lot of money to get through it.

For example, there were several chapters dedicated to very simple money saving tips. This is fine, okay, sure, but it also just drags the book out like crazy. I think more people would be “readers” if books were succinct and not written to a publisher’s arbitrary word count minimum, which is what a lot of Your Money or Your Life feels like.

Your Money or Your Life is actionable, but not practical

I believe there’s a distinct difference between a book being actionable and a book being practical. Actionable has a clear, distinct call to action. Practical is the ability for someone to follow through with what is being suggested. “Climb Mount Everest” is actionable. But is it practical?

A lot of Your Money or Your Life can you spend challenging the reader to do a massive inventory of every aspect of their financial life. It’s a call to count every penny, with absolutely no excuses. She says repeatedly how half measures will just make you financially slide back into old habits. And while I agree with this in theory, I think it’s just borderline impractical for 99% of readers. I consider myself fairly financially literate and responsible, and even I am entirely uninterested in doing the actionable steps of this book.

This book is so long because it spends so much of its time explaining these very actionable but unrealistic principles, that it really does become quite a slog to get through. Some of the book is way too specific, and some is way too broad.

This book excels when it asks the big questions

Like I’ve said, the actionable aspects of Your Money or Your Life don’t really resonate with me, but I do like the big questions that are asked about how your money aligns with your values. Money and values aligning isn’t talked about enough, as many people end up spending out of necessity for convenience or compulsion, but not necessarily spending on the things that provide value or bring meaning to their life.

I think it’s so easy to desensitize ourselves from our money so much that we end up spending on things that we don’t value, or even spend on things that actually go against our value systems, but we become blind to it through a lack of awareness.

Your Money or Your Life is great for people needing an overhaul

I do think that certain people would really benefit from this book. For example, when I was drowning in clutter and desperate for a change, The Life-Changing Magic of Tidying Up by Marie Kondo revitalized my life. I needed those incredibly practical steps to get out of my headspace and into a better mindset. I cannot overstate how important that book was to me. And I can see Your Money or Your Life having a similar effect on somebody drowning in debt and desperate for a change.

There are tons of financial books that are useless (like Get Rich, Lucky Bitch). Thankfully, Your Money or Your Life is not one of those. The book’s tagline is “transforming your relationship with money,” and I think that this is exactly who the book should appeal to: people whose relationship with money needs a complete transformation and overhaul. If you’re like me and are decent with money or have a system in place to handle your financial situation, this book is not for you.

Taking questions deeper and wider

One point that Vicki repeatedly brought up that I really did like was how to take money conversations deeper, by asking “why?” and taking conversations wider by asking “how has society shaped my answer?” I think this is a fantastic exercise, not just for money, but for all discussions. Sometimes it’s so easy to take answers at face value, but going deeper and broader in our interactions with others will make us richer, more dynamic, more informed, and more interesting.

FAQ about Your Money or Your Life

Who said your money or your life?

Vicki Robins and Joseph R. Dominguez coined this phrase in their 1992 book of the same title.

How many pages is Your Money or Your Life?

Your Money or Your Life is 368 pages.

Your Money or Your Life by Vicki Robin – Conclusion

I think this is an excellent book in theory, but it gets lost in the weeds. I do see why it is so famous because I think the idea of trading life energy for stuff was revolutionary at some point, but I think a lot of personal finance folks communicate the same message in ways that are more attainable and reasonable for the average, modern person.

I highly recommend those working towards achieving financial independence to spend time in FIRE communities, watch Dave Ramsey’s videos (yeah, he’s controversial, but his advice helped me a lot), and find the method that works for you.

Check out Your Money or Your Life on Goodreads or Amazon.

What are your thoughts? Let us know below 👇